What is a 1031 Tax-Deferred Exchange?

A 1031 exchange, named after section 1031 of the U.S. Internal Revenue Code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to buy a similar property. It is also sometimes referred to as a “like-kind” exchange.

1031 tax-deferred exchanges are also a useful way to save on capital gains taxes when selling business or investment real estate, particulary real estate that has seen a substantial increase in appreciation. For a tax exchange to be successful, there are specific rules that must be observed during the process.

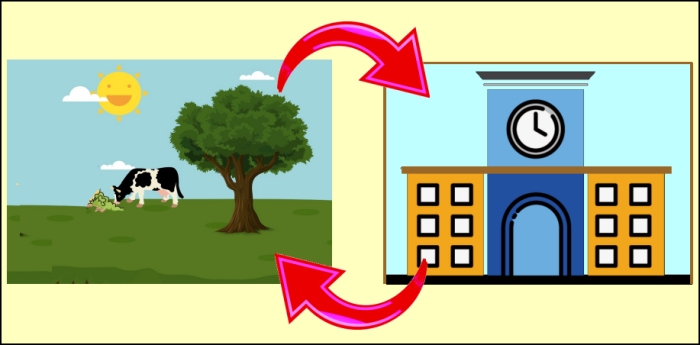

A “like-kind” exchange used to mean that if you sold a tract of land then you would have to re-invest in land. That has changed. Now you can exchange any type of real estate for another and it is considered like-kind. For example, you can sell your family farm and re-invest your gain into an apartment building.

**NOTE: The timing and the procedural rules of a 1031 exchange are very explicit and must be followed in order for the tax deferral to be successful.

There are two key timing rules that you must observe in a delayed exchange.

45-Day Rule

The first relates to the designation of a replacement property. Once the sale of your property occurs, the intermediary will receive the cash. You can’t receive the cash or it will spoil the 1031 treatment. Also, within 45 days of the sale of your property, you must designate the replacement property in writing to the intermediary, specifying the property that you want to acquire.

The IRS says you can designate three properties as long as you eventually close on one of them. You can even designate more than three if they fall within certain valuation tests.

180-Day Rule

The second timing rule in a delayed exchange relates to closing. You must close on the new property within 180 days of the sale of the old property.

Below are other rules that you must follow:

1. Prior to closing on the property that you are selling, you must identify the property that you are relinquishing. This language will be defined in the Purchase/Sale contract prior to ratification of the contract.

2. A qualified intermediary is essential to handle the transaction for you. One of the most important rules of the exchange is that neither you nor any of your agents (accountant, attorney etc) may touch the funds. Proceeds from the sale must be held in escrow by a qualified intermediary.

3. After closing, you have 45 days to identify the potential replacement properties. You can identify up to three replacement properties or any number as long as the total fair market value does not exceed 200% of the sales price of the relinguished property. If you change your mind on a property, it can be revoked but must still be within the 45-day window to do so.

4. Once you have identified your replacement property, you have 180 days from the closing of your relinquished property to close on your new property. Be careful, that your federal tax due date does not fall prior to the end of the 180 days, in which case you must have closed prior to your tax due date.

Additional Features

Your principal residence cannot be used in a 1031 exchange. However, if you own a substantial amount of acreage, the acreage can be used in an exchange, with values assigned to the residence and to the acreage.

You are not required to re-invest all the money received from the sale of the relinquished property into the new property . You can retain any amount of the receipts but that amount will be taxable.

If you are unable to locate a property of your choice within the 45 days, you will need to pay the capital gains.

If you find the perfect property first but have not been able to sell the property to be relinquished, there is a provision called a reverse-exchange. Reverse exchange rules are fairly similar, and in that case you have 180 days to sell your property.

***As always, you should consult with the following prior to opting for a 1031 exchange: your accountant, attorney, intermediary and real estate agent…. in order to ensure that the 1031 tax-deferred exchange will meet your financial goals.