Are you looking for the perfect home in Charlottesville, Virginia? Learning the average closing costs in Charlottesville, VA, is your first best move. Check out the information below for more details.

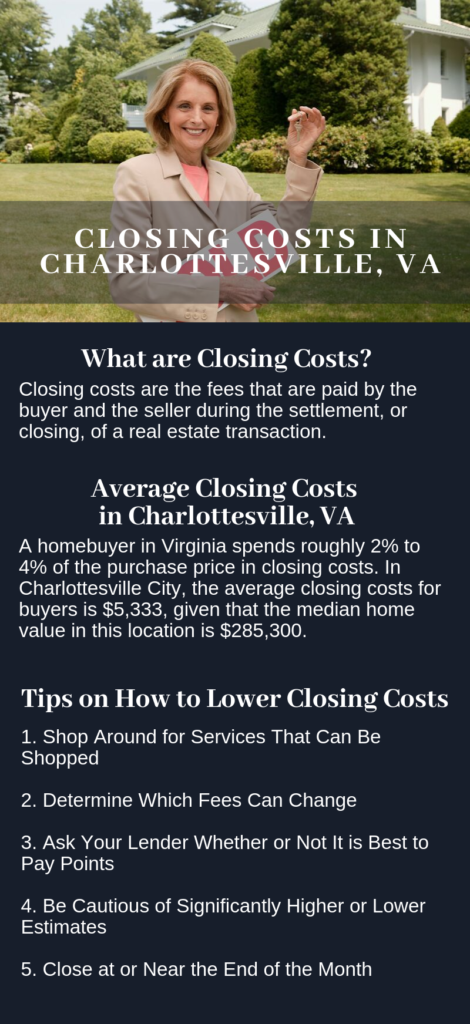

What are Closing Costs?

Closing costs refer to all the various fees and charges that are paid by the buyer and the seller during the settlement of a real estate transaction. Generally, it is the buyer who shoulders most of the closing costs. However, in some instances, the seller may agree to pay for some of the costs. The fees and legal requirements that are included in the buyer’s list of closing costs usually differ for each state and municipality, and this is why it is ideal for homebuyers to work with a qualified and experienced real estate expert so that they are given the appropriate assistance necessary to get the best deal out of their home purchase.

Average Closing Costs in Charlottesville, VA

In general, home prices in the state of Virginia are higher than the national average, primarily because of its proximity to Washington, DC. On the up side, though, Virginia homeowners save on property taxes, since the state’s effective tax rate is well below the national average.

Average Buyer’s Closing Costs in VA

A homebuyer in Virginia spends roughly 2% to 4% of the purchase price in closing costs. In Charlottesville City, the average closing costs for buyers is $5,333, given that the median home value in this location is $285,300. Certain fees and taxes vary by state and locality, but in Virginia, it is customary for the buyer and the seller to cover the taxes and fees associated with their portion of the transaction and for the seller to pay the commissions of both the brokers/agents representing the buyer and the seller.

Prior to closing day, the homebuyer is required to schedule a home inspection. It is the buyer’s responsibility to discover any property defects. A home inspection typically costs around $300 to $400, but this depends on the actual square footage of the property. For additional tests, such as mold, termites, asbestos or radon, the buyer will have to pay an additional fee for each service.

Lender fees would include the cost of underwriting and processing the buyer’s loan, points paid to reduce the interest rate, appraisal cost, and any other lender-related costs. These costs would usually total at least $1,000 to $2,000, plus any points purchased to bring down the rate which is around .5% to 1% of the loan amount.

The title fees include lender-required title insurance, optional buyer’s title insurance, deed preparation, title abstract search, land survey, and other processing fees involved in preparing the legal and administrative documents of the home purchase. These costs usually range between $500 to $1,500, plus the cost of title insurance, which is around .25% to.75% of the home purchase price.

The buyer is also responsible for state and local taxes, which amounts to roughly .5% to.75% of the purchase price. Most lenders require homebuyers to pre-pay property tax and homeowner’s insurance which are held in escrow to ensure payment. These charges amount to .5% of the sale price on average.

Average Seller’s Closing Costs in VA

Sellers in Virginia usually pay around .25% of the home purchase price in closing costs, plus the commissions that they have agreed to shoulder. In this state, it is tradition for the seller to cover the commission for their representing broker/agent as well as the commission of the buyer’s representing broker/agent. The average range for title fees paid by the seller is $500 to $1,000.

The homebuyer may negotiate to have the seller pay up to 100% of the closing costs, which is known as seller credits.

Breakdown of Closing Costs for Homebuyers in Charlottesville, VA

- Appraisal Fee

- Credit Report

- Interest Payment

- Escrow Account

- Property Taxes

- Transfer Taxes

- Recording Fees

- Homeowners Insurance

- Title Insurance

- Points (optional)

- Flood or Quake Insurance (optional)

- Private Mortgage Insurance (PMI) (optional)

Tips on How to Reduce a Homebuyer’s Closing Costs

Learning about all the fees and charges related to closing can be quite overwhelming for homebuyers, especially those who are buying their home for the first time. But, the good news is, closing costs are not set in stone and there are a lot of ways to reduce these. Here are some practical tips for homebuyers who are looking for ways to lower their closing costs:

1. Shop Around for Services That Can Be Shopped

Most homebuyers know that they can shop around for mortgage rates, but there are other fees that you can shop for, such as title insurance and pest inspection fees. Check the Loan Estimate details to see which services you can shop for and which ones you can’t. Lenders are not required to provide an estimate before you apply for a loan, but you should be able to get a ballpark figure. It is also a must to get quotes from more than one lender.

2. Determine Which Fees Can Change

Not all of the fees listed on your Loan Estimate are fixed, some of these can change. For example, if you use a company that has been recommended by your lender, certain fees like your title services, lender’s title insurance, and owner’s title insurance cannot increase by more than 10% at closing. However, if you opted to use service providers that were not listed in the Loan Estimate, there is no limit on how much the costs could rise.

3. Ask Your Lender Whether or Not It is Best to Pay Points

While you have the option to pay discount points in exchange for a lower interest rate, some experts say that paying points may not be worth it when mortgage rates are already low. However, others recommend buyers to pay points even when mortgage rates are low, especially if they plan on keeping the home long term. So, to know whether or not buying points would be to your advantage, ask your lender.

4. Be Cautious of Significantly Higher or Lower Estimates

While it is a given that closing costs differ from state to state, most third-party fees should be somewhat comparable. So, if you notice any third-party charge that is much higher or lower than the average, it is best for you to ask the lender about it before you decide to use them as your lender or title insurance provider.

5. Close at or Near the End of the Month

Closing toward the end of the month can help you save on prepaid interest, which accrues from the closing date to the end of the month. The closer your closing date is towards the end of the month, the lesser your prepaid rate, since there are fewer days in between these two dates. For example, if you chose to close on the 15th, you will have to pay for 15 days of interest, whereas closing on the 30th would only cost you a day’s interest.

If you are looking for the perfect home in Charlottesville, Virginia for you and your family, I will be very happy to show you all your options in this area. Feel free to give me a call at (434) 960-0161 or send me an email at Pam@PamDent.com to schedule an appointment.

Related Article: Cost of Living in Charlottesville, VA